The Picasso Problem: Why the Future of Investing Looks Abstract, with Bitcoin as the Epilogue

Introduction: A Dot That Finally

Connected

This week I listened to a Tim

Ferriss interview with Bill Gurley. Gurley has long been one of my favorite

thinkers, in part because of his connection to the Santa Fe Institute. The

Santa Fe Institute is a pioneering research center focused on understanding

complex adaptive systems, and Gurley serves as a trustee, reflecting his belief

that markets, technology, and investing are best understood through the lens of

complexity science.

When I’m looking for deeper

answers, I’ll often reframe a question to an LLM using this same Santa Fe

Institute lens, modeling the system rather than the headline, and tracing

second and third order effects. In this interview, Gurley made an observation that

stayed with me longer than most market commentary as I was riding the subway.

He referenced Pablo Picasso, not

the abstract revolutionary we remember, but the young realist. Picasso, Gurley

noted, was technically brilliant long before Cubism. He could paint reality as

well as anyone alive. His move toward abstraction wasn’t a rejection of skill;

it was a recognition that realism had stopped being the frontier.

That comment connected a dot for me.

Because the same tension now exists

in investing.

Picasso and the End of Realism as an Edge

Picasso’s early realism proved

mastery. But mastery of realism became less valuable once photography emerged.

Reality could be captured faster, cheaper, and more accurately by machines.

So Picasso moved on, not because

realism was wrong, but because it was finished.

Abstraction allowed him to show

multiple perspectives at once. It was harder to understand, easier to dismiss,

and impossible to value using traditional criteria. But it was also the future.

Gurley’s point wasn’t really about

art. It was about phase transitions.

When the tools of realism become

commoditized, the advantage shifts to interpretation.

That is exactly where investing is

today.

Daniel Pink, Revisited Through an AI Lens

I often reference Daniel Pink’s A Whole New Mind because it captured something fundamental: the world was moving from

left-brain dominance, logic, analysis, optimization, toward right-brain

capabilities like synthesis, pattern recognition, and meaning.

What struck me recently is how

completely AI finishes Pink’s argument rather than contradicts it.

AI doesn’t just assist analytical

work.

It eliminates its scarcity. Forecasting, modeling,

optimization, once the domain of elite human cognition, are now automated,

scalable, and increasingly cheap. The value of being precisely right about the

present is collapsing.

What remains scarce is not accuracy.

It’s perspective.

Pink anticipated a conceptual age.

AI accelerates us into something more extreme: an abstract age, where meaning

arrives before measurement and structure emerges before labels.

The Market’s Mistake About AI

Bill Gurley made another

observation in that interview that matters here:

“The institutional investors have zero interest in non‑AI deals. Zero.”

That tells us something important.

The market believes AI is the new

realism, the obvious, necessary investment. Infrastructure, models, compute,

applications. Capital feels comfortable here because these things can still be

modeled, benchmarked, and justified.

I don’t believe AI is a bubble.

But I do believe the market is

confusing where money is going with where understanding ends.

AI may be the new realism.

But the future created by AI is abstract.

That distinction matters.

Investing in a World That Is No Longer Legible

Realist investing assumes:

· Stable categories

· Linear progress

· Measurable adoption

· Clear valuation anchors

AI breaks those assumptions.

As AI reshapes labor, productivity,

creativity, and coordination, outcomes become harder to forecast and easier to

misinterpret. Value migrates faster than accounting systems can track it.

Confidence decays even as capability explodes.

Companies no longer fit stable

categories. Tesla isn’t a car company or a tech company, it’s both and neither.

Oracle carries massive remaining performance obligations from AI infrastructure

deals, yet faces real execution risk if monetization lags or if debt matures

before backlog converts to cash flow.

The uncertainty isn’t about whether

opportunity exists, it’s about whether traditional frameworks can time it.

This is not a world that rewards

better spreadsheets.

It rewards those who can hold

ambiguity without demanding premature clarity.

Just as Cubism looked chaotic

before it looked obvious, abstraction in investing appears irrational before it

becomes self-evident.

From Realism to Abstraction,

Personally

Tracing this arc from Picasso, to

Pink, to Gurley’s observations on AI capital flows, clarified something for me.

The shift we are living through is

not simply technological.

It is

epistemological.

It’s about how we know what we know.

We are moving from a world where

realism worked to one where abstraction is required, not because it is elegant,

but because reality itself has become multi-dimensional and unstable.

This is not an argument against

investing in AI infrastructure. Infrastructure is always a means, not an end.

The question is not whether AI matters; it does.

The question is: what investment framework survives in the world AI

creates?

That realization eventually brought

me to Bitcoin.

Epilogue: Bitcoin

Bitcoin is abstract.

It has no cash flows.

No

issuer.

No

traditional valuation framework.

No

single function.

And that is precisely why it

persists.

Bitcoin does not resolve

uncertainty, it absorbs it. It exists

as a constrained, neutral system in a world where trust, measurement, and

control are increasingly fragile under the weight of AI-driven change.

Bitcoin is not the answer to AI.

It is the companion to the

uncertainty AI introduces.

In that sense, Bitcoin is not the

subject of the painting.

It is the detail that only becomes

visible once realism has failed and abstraction becomes necessary.

By the time investors recognize

this, perhaps in hindsight, perhaps around 2026, the question won’t be whether

Bitcoin made sense.

It will be whether we were asking

it to make sense too early, using the wrong lens.

Realism didn’t disappear.

It just stopped being enough.

And abstraction, first dismissed,

then tolerated, quietly became essential.

Now I want to thank you all for

spending part of your year with me and for sharing this Substack with others.

Writing here has been a grounding force for me, and I hope these pieces have

sparked reflection and offered some steadiness in a world that often feels

increasingly uncertain.

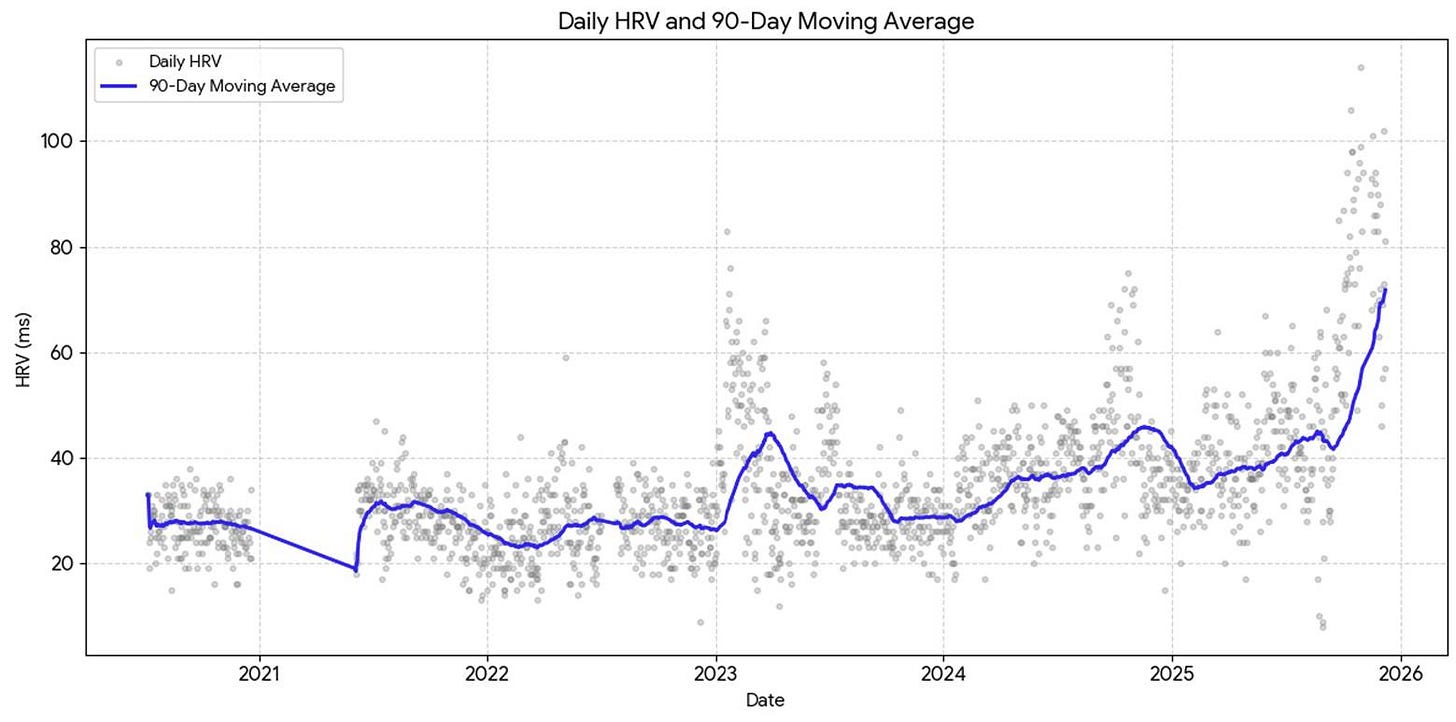

Beginning next year, I’ll be

starting a second Substack focused on something deeply personal: my journey to

improving heart rate variability (HRV), and what it has taught me about

learning, anxiety, health, and happiness in an age of exponential change. I’ve

come to see this journey as important not just for me, but for my children as

well as part of the example and guidance we all try to set while helping them

grow up in a world that is changing faster than any generation before them.

Think of it as a book written one chapter at a time, with each week reflecting

something I learned over a five-year process of trial, error, and gradual

understanding. This is my message to all books in the future to not be repetitive with the same message every chapter but a journey where you can double click to understand and use the information.

At the end of each post, I’ll

include a simple prompt so you can explore the ideas further in your own way,

often using systems-thinking approaches like the Santa Fe Institute lens I

mentioned earlier. This will be done in a way that I guarantee will help

you on your journey of incorporating AI into your life and your whole family.

What this journey has taught me is

that HRV isn’t something you “optimize” through a Type-A mindset or harder

workouts alone. It improves through balance both through health, internal and

external but also in your relationship with nature and technology which works

against each other.. And that lesson applies far beyond health to how we work,

how we show up in relationships, and how we pursue a more grounded sense of

happiness.

I’m grateful you’re here, and I’m

excited to share this next chapter with you and, ultimately, with the next

generation as well.

This chart of my five year journey

isn’t about optimization or shortcuts, it’s a quiet record of what balance

looks like over time.

Wishing you

and your family a peaceful, healthy holiday season and a hopeful start to the

year ahead.

Jordi, your work both on Substack and on YouTube videos is much anticipated by me, and apparently by so many others.

Thank you for your work and insights over the past year. All the best to you and your family in this holiday season and in 2026.

FWIW I’m a senior citizen, BtC MSTR hodler.

I have an M.Sc in economics from the LSE and gave it up over 50 years ago (yikes!!!) because it was too boring to consider as a lifelong profession—writing meaningless papers, and watching the 1971 gold rug pull by Nixon along with the inevitable dollar debasement to further enrich the already rich without any remedy then in sight.

I have been encouraged to see so many new, younger voices explaining and opening this new world that bitcoin and AI are presenting to all of us.

Thanks again. Alan

Always thrilled with your commentary on the markets and beyond. Looking forward to hearing more about your own personal journey with HRV. Happy holidays! May your stocking be full of bitcoin 🎄